Sources of financial instability in Latin America in the face of Covid-19 expansion

May 15, 2020

author: http://www.sela.org | Leonardo Martínez *

There is no precedent for the agglomeration of financial, trade and social shocks that coexist in the world economy. They are the result of the implementation of health containment measures to prevent the deaths of 40,624 million citizens worldwide[1] vis-à-vis the expansion of COVID-19. Its consequences occur in an international context of greater trade and financial interconnectivity, in which a nation's actions to contain the pandemic affect simultaneously and in greater proportion the rest of the countries.

The IMF (2020) forecasts a global recession, with Latin America and the Caribbean being the most affected region with a decline of 5.2% in 2020. In this scenario, some rifts are found in the dynamics of global supply and demand that could eventually be part of the recipe for triggering in the world, in particular within emerging economies, a financial crisis. The main sources of financial instability in the region are: lower commodity prices, rising external public financing costs, deteriorating business productivity, and rising unemployment in labour markets.

Sources of instability in international markets

Halt in economic activity and uncertainty about the evolution of the pandemic will lead to a reduction in global trade in goods and services. By 2020, global trade is estimated to fall by 11% due to the decline in aggregate demand from India, China, the United States and Europe, the region's main trading partners (IMF, 2020). This expectation led to a fall in commodity prices in international financial markets due to oversupply.

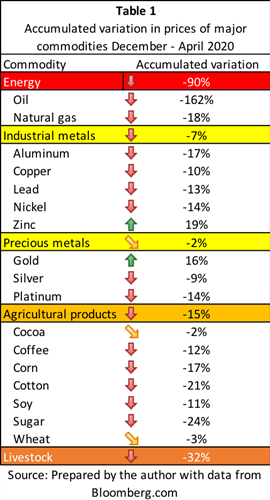

The most affected items are energy, minerals for use in medium-tech manufacturing, and agricultural products (see Table 1). Given the variation in volume and price of the main products that make up the region's export basket, the trade deficit in the balance of payments is expected to grow especially for oil-producing countries.

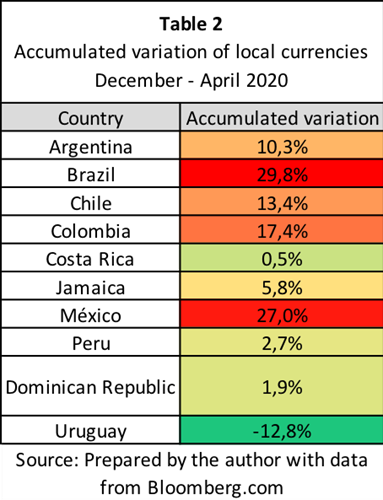

Forecasts of the negative performance of the region's export activity coincide with the investors' aversion to risk in international markets. Restructuring their portfolios into safeguard assets and cash positions led to the sale of bonds and assets from Latin American markets. In emerging markets alone, the United Nations Conference on Trade and Development (UNCTAD, 2020) estimates that the outflow of investment capital in stocks and bonds was approximately US$ 59 billion between February and March 2020, doubling the maximum figure achieved during the Global Financial Crisis in 2008. This factor has led to a sharp depreciation of Latin American local currencies against the US dollar, a safeguard asset (see Table 2). Both pressures on the depreciation of local currencies and the permanent volatility in the foreign exchange market increase the pressure on private debt that financial and non-financial institutions maintain.

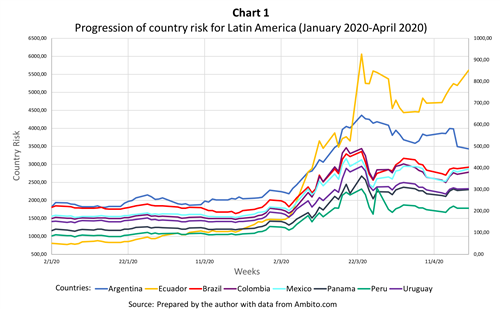

The confluence of these factors led to an increase in the costs of public indebtedness in foreign currency (Carvallo, 2020). The spread between sovereign debt bonds and U.S. Treasury bonds has increased significantly in the face of uncertainty regarding regional performance (Chart 1). The impact on the stability of public and private finances is expected to be significant for those countries with high levels of foreign currency-denominated debt, fiscal and foreign deficits, and low levels of international reserves (idem).

The ability to mitigate the effects of the pandemic on the real economy through fiscal stimulus programmes, controls on financial and exchange markets, and global health care services are constrained by the narrow and limited fiscal space of the region's economies. The World Bank (2020) explains that this constraint on the feasibility of programmes is due to a significant fiscal deficit and a considerable degree of foreign currency indebtedness. Restrictions may be exacerbated in countries facing a reduction in their tax collection, sharp depreciation of the local currency, high levels of inflation and whose exporting structure is most exposed to the reduction in the oil price.

Sources of instability in local markets

The productive performance of the non-financial sectors in the region is determined by restrictions on transport and influx of consumers and employees. Sectors that are most vulnerable to internal restrictions, and thus to shortages of liquid assets to meet their obligations in the face of declining incomes, use intensively the work factor. The use of digital communications is incompatible with the execution of their sales and distribution processes.

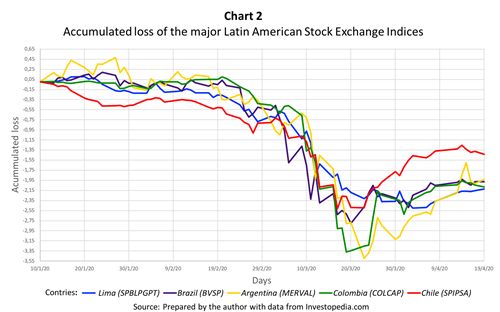

The magnitude of the impact on the productive and commercial activity of companies in Latin America and the Caribbean is reflected in their quarterly reports of profits issued in the first quarter of the year. One hundred and twenty-four Latin American companies that make up the Top 5000 of Large Multinational Enterprises (MNEs) estimate a reduction in their revenue by 14%, with the following being the most affected sectors: Production of basic materials, Airlines, Hotels, Restaurants, Fun and Leisure, Energy, Automobile manufacturing and Auto parts (UNCTAD, 2020). This forecast of company performance has been based on the valuation of their shares on local and international stock markets. The indices that capture the value of shares traded on the region's stock exchanges accumulate an average reduction in their value by 28% between January and April 2020 (see Chart 2).

In addition to liquidity risk, the local currency leverage ratio of Latin American companies to cover working capital and investment in fixed assets has increased in recent years (Abeles M., Caldentey E., and Valdecantos, 2018). This factor weakens the ability of companies to cope with the shock caused by the application of containment measures on the business own income. This vulnerability may be greater in those economies facing an upsurge in macroeconomic and local financial market shocks.

Adjusting companies to maintain their operation and profitability would inevitably lead to unemployment of a significant proportion of formal workers, generating a source of solvency risk for mortgage, consumption, payroll and household loans. The International Labour Organization (ILO, 2020) estimates that 43.2% of formal employees in Latin America work in the most vulnerable sectors, such as Tourism, Food services, Manufacturing, Commerce, Real estate and Business activities. This proportion represents the largest population at risk compared to other regions of the world.

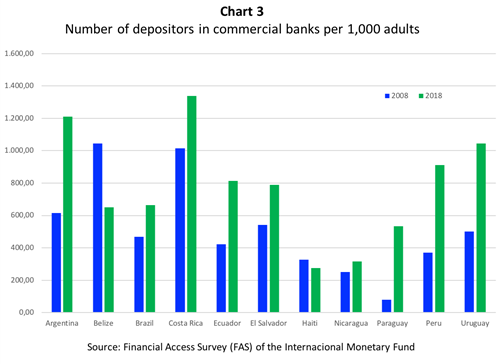

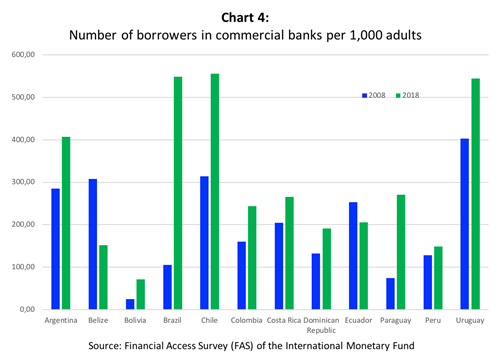

Currently, financial institutions are a source of deposit and financing for a larger number of businesses and households than in 2008 (see Charts 3 and 4). This condition has been the result of the implementation of financial inclusion policies that promote access to and use of commercial banking products and services. However, the capital market is widely segmented in Latin America, as far as the source of deposits and credit portfolio is concerned. Roa and Carvallo (2018) identified that commercial banking is the main recipient of deposits and issuer of loans for large companies; while SMEs and households from a lower socio-economic background are mostly served by microfinance banks . For this reason, the solvency risk of SME and vulnerable household loans to which the latter sector is exposed is greater compared to commercial banking. In this connection, the liquidity risk associated with reduced deposits by these agents increases as health containment measures are prolonged and the decline in their income becomes permanent.

In addition, deteriorating household and business conditions could lead to a reduction in demand for financial products and services offered by banking (Baret, Celner, Reilly, and Shilling, 2020). This demand shock would affect income collected through financial intermediation and conventional operations; a picture that financial analysts take for granted for Chile, Peru and Colombia (Marquez, Martínez and Paiz, 2020), and that the U.S. financial system already projects for the issuance of its next quarterly revenue reports.

Mitigating the impact of the crisis

In view of the above, the aim is to identify the sources of financial instability that emerge through transmission channels within the system as one of the priority policies that must be developed by the most affected governments. As financial stability shocks emerge through contagion channels, conditions in the non-financial sectors and households deteriorate, and the chances for a productive recovery and the minimisation of job losses decrease (IMF, 2020). The regulator’s dilemma is to ensure the functioning of the real economy through financial stimulus measures that do not jeopardise the structure of banking institutions or provide a source of imbalance for public accounts in the medium term.

The Economic Commission for Latin America and the Caribbean (ECLAC, 2020) promotes a policy programme based on 4 pillars: (a) provide fiscal stimulus to support health services and protect income and jobs; (b) expand the capacities of the social assistance system; (c) ensure the liquidity of the financial system and prevent disruption of payment chains; (d) request sources of funding and technical support to international cooperation mechanisms or multilateral organizations.

Advances in financial inclusion allow for greater scope of financial relief programmes for agents in the economy. The effectiveness of this mechanism is subject to the operation of the means of payment, the size of the banked population and the availability of digital access points, not to mention the stability of the banking system. To that end, the World Bank (2020) stresses the need to deepen the action capacities of financial regulators in order to facilitate debt renegotiation processes and offer guarantees of protection to banking institutions in the face of the expected decline in financial intermediation income.

These policy instruments could mitigate the effects on the region's economies vis-à-vis the exposure to structural vulnerabilities that cause the financial instability of the system. Its development must ensure the full recovery of the system, within an environment of internal and external institutional coordination. Only in this way can uncertainty about the possibilities for economic recovery be dispelled, once pandemic containment measures are eliminated.

Bibliographical references

Abeles M., Caldentey E., and Valdecantos (Ed.) (2018). Estudios sobre financierización en América Latina. Economic Commission for Latin America and the Caribbean (ECLAC). Retrieved from: https://repositorio.cepal.org/bitstream/handle/11362/43596/6/S1700173_es.pdf

Baret, S., Celner, A., Reilly, M., and Shilling, M. (2020). COVID-19 potential implications for the banking and capital markets sector: maintaining business and operational resilience. Blog Deloitte Insight. Retrieved from: https://www2.deloitte.com/us/en/insights/economy/covid-19/banking-and-capital-markets-impact-covid-19.html

Carvallo, E. (2020). América Latina ha sufrido paradas súbitas en el pasado: El coronavirus lleva el desafío a un nuevo nivel. Blog Ideas que Cuentan of the Inter-American Development Bank (IDB). Retrieved from: https://blogs.iadb.org/ideas-que-cuentan/es/america-latina-ha-sufrido-paradas-subitas-de-los-flujos-de-capital-en-el-pasado-el-coronavirus-lleva-el-desafio-a-un-nuevo-nivel/

Economic Commission for Latin America and the Caribbean (ECLAC, 2020). América Latina y el Caribe ante la pandemia del COVID-19: efectos económicos y sociales. Informe Especial Nº1 COVID-19 (April 2020). Retrieved from: https://repositorio.cepal.org/bitstream/handle/11362/45337/4/S2000264_es.pdf

International Monetary Fund (IMF, 2020). The Great Lockdown, Chapter 1. World Economic Outlook (April 2020). Retrieved from: https://www.imf.org/~/media/Files/Publications/WEO/2020/April/English/text.ashx?la=en

Marquez, A., Martínez, A., and Paiz, T. (2020). Fitch Rtgs Revises Bank Sector Outlook in Chile, Peru and Colombia to Negative on Coronavirus Risks: Non-Rating Action Commentary. FitchRatings Blog. Retrieved from: https://www.fitchratings.com/research/banks/fitch-rtgs-revises-bank-sector-outlook-in-chile-peru-colombia-to-negative-on-coronavirus-risks-27-03-2020

International Labour Organization (ILO, 2020). COVID-19 and the world of work, Second edition. ILO Monitor (April 2020). Retrieved from: https://www.ilo.org/wcmsp5/groups/public/@dgreports/@dcomm/documents/briefingnote/wcms_740877.pdf

United Nations Conference on Trade and Development (UNCTAD, 2020a) The Covid-19 Shock to Developing Countries: Towards a “Whatever it takes” programme for the two thirds of the worlds population being left behind. Trade and Development Report Update (March 2020). Retrieved from: https://unctad.org/en/PublicationsLibrary/gds_tdr2019_covid2_en.pdf

United Nations Conference on Trade and Development (UNCTAD, 2020b) Impact of the COVID-19 Pandemic on Global FDI and GVCs: Investment Trends Monitor (March 2020). Retrieved from: https://unctad.org/en/PublicationsLibrary/diaeiainf2020d3_en.pdf

World Bank (WB, 2020). The Economy in the Time of COVID-19: Semiannual Report of The Latin America and Caribbean Region (April 2020). Retrieved from: https://openknowledge.worldbank.org/bitstream/handle/10986/33555/9781464815706.pdf?sequence=5&isAllowed=y

- Analyst of Studies and Proposals of the Permanent Secretariat of SELA

[1] This estimate refers to a scenario where sanitary measures to contain the expansion of COVID-19 would not have been implemented. The reference was taken from The Global Impact of COVID-19 and Strategies for Mitigation and Suppression (Imperial College London (2020)).