|

Financial markets across Latin America and the Caribbean (LAC) ended the first quarter of 2016 on a high note, according to ECLAC Washington Office’s report Capital Flows to Latin America and the Caribbean: Q1 2016. Monetary easing by major central banks, a firming of commodity prices, and increasing confidence that the U.S. Federal Reserve was not planning to raise interest rates again, powered stocks and bonds higher.

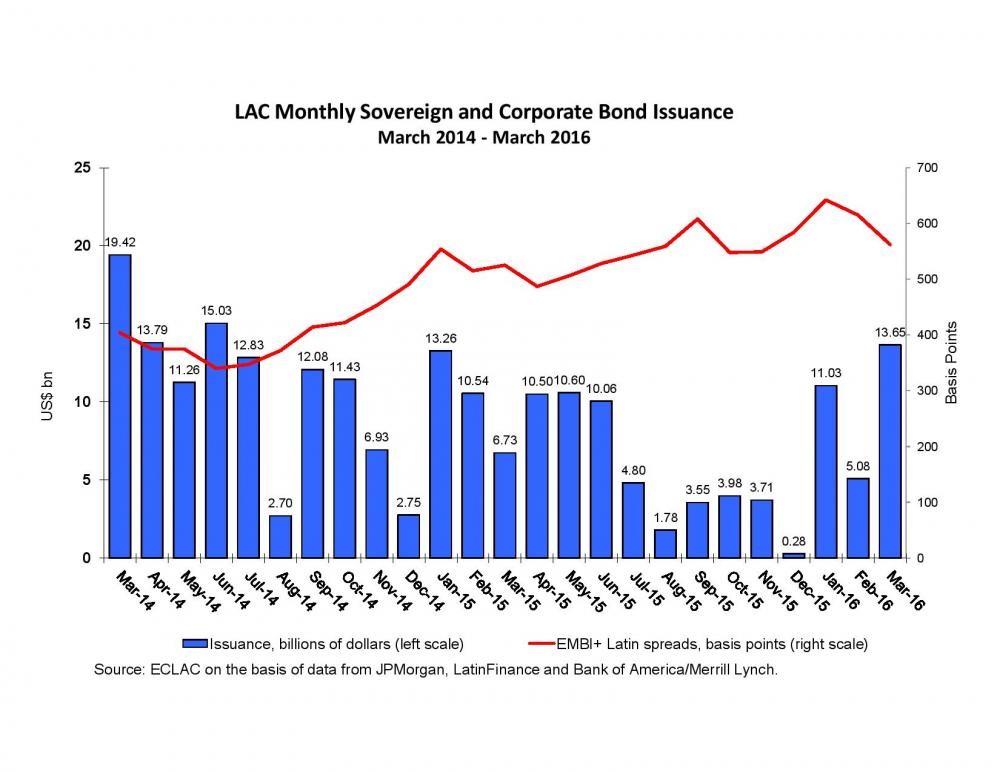

Heightened market volatility in the early part of the first quarter made issuance difficult for even the best rated issuers, but a strong rally in March made for better issuance conditions. Total LAC debt issuance reached US$ 29.76 billion in the first quarter of 2016, compared to US$ 30.54 billion in the same period in 2015, 3% lower. But it was a big improvement from the US$ 18.10 billion issued in the whole second half of 2015 (there was a considerable slowdown in LAC debt issuance from July to December 2015, as volatility and lower commodity prices loomed over the region). For an overview of the main trends of 2015, see Capital Flows to Latin America and the Caribbean: 2015 Overview.

Despite the improved sentiment at the end of the quarter, the external environment remains challenging and the credit quality of some of the region’s borrowers has raised investors’ concerns.

Attachments

|